If you have a storefront, then you're probably used to charging sales tax. Unless you live in the sales tax free states of Alaska, Delaware, Montana, New Hampshire, or Oregon, in which case we'd like to note that it's rude to brag so please don't bring that up.

Sales tax is pretty easy when charged in person. Your state has a sales tax. In California, for example, it's 7.5 percent. Your county probably also has a sales tax. In San Francisco it's 1.25 percent. These taxes are combined and become the tax charged to customers. Which is why if you walk into a hardware store in San Francisco and buy a $10 hammer, your tax rate is 8.75 percent and you pay $10.88 for it.

Here's where it gets tricky. What if you're not buying that hammer in person in San Francisco, but are instead ordering it over the Internet from Los Angeles? Or from even farther away in Chicago? What taxes should the hardware store charge you then?

We could consider this by diving into discussions of Nexus and whether or not you live in a state with Destination or Origin based sales tax rules. And Weebly does have an article about these topics.

But why do that, when we could use Weebly's new Automatic Tax Calculator instead?

The Automatic Tax Calculator

This is exactly what it sounds like: a calculator that determines the tax rate you need to charge each and every one of your customers.

You'll find this calculator in the editor under Store > Setup > Taxes. It's available with the Business Plan and above.

There is an important first step with the tax calculator: make sure you enter any addresses associated with your business. Why? Whether or not you need to charge sales tax to a specific customer is based on whether or not your business has a physical location in that customer's state, country or economic zone. We can't properly calculate tax rates without this info.

Here's where it gets tricky. What if you're not buying that hammer in person in San Francisco, but are instead ordering it over the Internet from Los Angeles? Or from even farther away in Chicago? What taxes should the hardware store charge you then?

We could consider this by diving into discussions of Nexus and whether or not you live in a state with Destination or Origin based sales tax rules. And Weebly does have an article about these topics.

But why do that, when we could use Weebly's new Automatic Tax Calculator instead?

The Automatic Tax Calculator

This is exactly what it sounds like: a calculator that determines the tax rate you need to charge each and every one of your customers.

You'll find this calculator in the editor under Store > Setup > Taxes. It's available with the Business Plan and above.

There is an important first step with the tax calculator: make sure you enter any addresses associated with your business. Why? Whether or not you need to charge sales tax to a specific customer is based on whether or not your business has a physical location in that customer's state, country or economic zone. We can't properly calculate tax rates without this info.

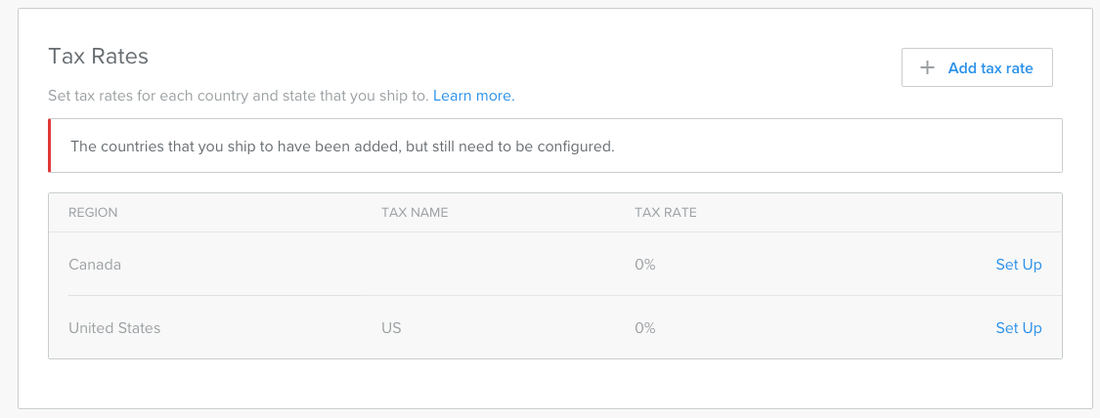

Underneath this address section you'll find the Tax Rates. Listed here will be every country or region for which you've previously created shipping rules. If you've created no shipping rules, then you should wait and set up taxes after you've done so, or manually add destinations with the Add Tax Rate button.

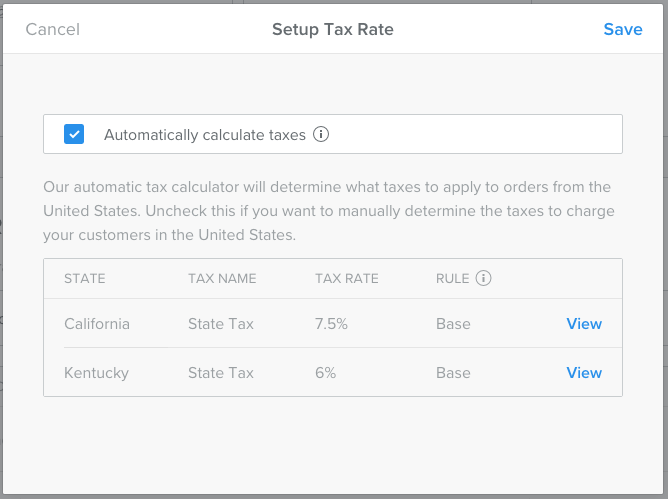

When you set up a country, you're presented with the tax rates that may potentially impact you. For our hardware store example, we see base taxes for California and Kentucky in the US because the store has a physical presence in both states and as a result these are the only states where we'll need to charge sales tax.

If you click on View next to each state rate you'll see the municipal tax rate for every single zip code in that state. You don't need to do anything with this info, it's just there if you want it. All you really need to do at this point is click Save. Then you're all set and Weebly will start calculating taxes for your individual customers after you next Publish your site.

If you click on View next to each state rate you'll see the municipal tax rate for every single zip code in that state. You don't need to do anything with this info, it's just there if you want it. All you really need to do at this point is click Save. Then you're all set and Weebly will start calculating taxes for your individual customers after you next Publish your site.

Note that if you'd prefer to manually handle your taxes, you can do that. However, we recommend that you don't take this manual option unless you're a tax expert or have spent a lot of time consulting one.

Other Tax Options to Consider

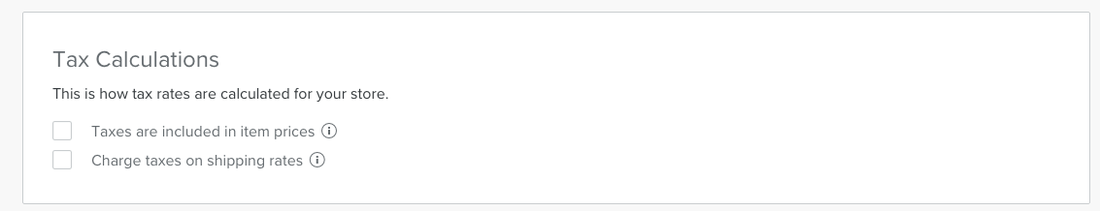

Underneath the Tax Rates box are two settings that are switched off by default, but that you may want to consider turning on.

Other Tax Options to Consider

Underneath the Tax Rates box are two settings that are switched off by default, but that you may want to consider turning on.

Taxes Are Included in Item Prices

If you've already included the cost of taxes in your item prices, then you should check this box. We'll tell you (and the customer) the total amount of their payment that has gone to taxes, but will not add any tax charges to their order.

This is common in Europe and around the world, as many countries charge a Value Added Tax that is the same across the entire country. This makes it easy for businesses to simply include that tax in the price of their products.

Because of the extreme variation in rates across the US, customers here do not expect the tax to be added until checkout. So you should really only check this box if you're in a country with a VAT and have already priced the tax rate into each product.

Charge Taxes on Shipping Rates

Some US States (and various countries) consider shipping charges to be taxable. Some do not. If your business is located in the US, we'll determine this for you automatically (assuming you're using our tax calculator discussed above). There's no reason to check this box unless you've manually set up all your rates or are located outside of the US in a country that requires sales tax be charged on shipping.

It's a time honored tradition to complain about taxes. With the new sales tax tools released with Weebly 4 you'll spend less time and energy collecting those taxes, giving you even more time to complain about paying them.

Ready to get your idea off the ground but don't have a website yet? Get started for free today by clicking here!

If you've already included the cost of taxes in your item prices, then you should check this box. We'll tell you (and the customer) the total amount of their payment that has gone to taxes, but will not add any tax charges to their order.

This is common in Europe and around the world, as many countries charge a Value Added Tax that is the same across the entire country. This makes it easy for businesses to simply include that tax in the price of their products.

Because of the extreme variation in rates across the US, customers here do not expect the tax to be added until checkout. So you should really only check this box if you're in a country with a VAT and have already priced the tax rate into each product.

Charge Taxes on Shipping Rates

Some US States (and various countries) consider shipping charges to be taxable. Some do not. If your business is located in the US, we'll determine this for you automatically (assuming you're using our tax calculator discussed above). There's no reason to check this box unless you've manually set up all your rates or are located outside of the US in a country that requires sales tax be charged on shipping.

It's a time honored tradition to complain about taxes. With the new sales tax tools released with Weebly 4 you'll spend less time and energy collecting those taxes, giving you even more time to complain about paying them.

Ready to get your idea off the ground but don't have a website yet? Get started for free today by clicking here!

RSS Feed

RSS Feed